In this article we will take a look at ten best monthly dividend stocks to buy in 2025.

Dividend investing is one of the most time tested and reliable ways to build wealth. For income focused investors, especially retirees or those seeking passive income, monthly dividend stocks offer a unique advantage, consistent cash flow. While many companies pay dividends quarterly, monthly paying dividend stocks provide a steady stream of income, making them appealing for budgeting and reinvesting purposes. But how do dividend stocks actually work, and is buying them really worth it in 2025?

At the core, dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of cash payments, known as dividends. These can be issued monthly, quarterly, or annually, but monthly dividend stocks offer smoother, more predictable income. The dividend yield, calculated as the annual dividend divided by the stock price, is a key metric that shows how much income you’re earning for each dollar invested. Another important factor is the payout ratio, which indicates the portion of earnings paid out as dividends. A sustainable payout ratio typically under 75% is crucial to ensure the company can maintain or grow its dividend.

So, why invest in dividend stocks? The benefits are twofold: recurring income and potential capital appreciation. You earn regular payments that can either supplement your income or be reinvested to compound growth. Over time, reinvested dividends can significantly increase your total returns, particularly if you’re investing in strong, dividend growing companies.

Getting started with dividend investing is easier than ever. You can open a brokerage account, screen for dividend paying stocks (focusing on those with a healthy yield, low payout ratios, and consistent payment history), and begin building a portfolio. Many investors start with dividend focused ETFs or REITs, especially those with monthly payouts.

The investment mechanics are straightforward: when a company declares a dividend, shareholders as of a specific "record date" receive a payment on the "pay date." Most platforms even allow for automatic dividend reinvestment (DRIP), compounding your returns over time.

In 2025, with inflation concerns and market uncertainty, monthly dividend stocks provide a rare combination of reliability and growth. In this article, we’ve rounded up the ten best monthly dividend stocks to buy in 2025, all with market caps over $300 million, solid financials, and attractive yields. If you are ready to turn your money into a monthly paycheck, these picks are a great place to start.

Our approach to determining the monthly dividend stocks to buy in 2025

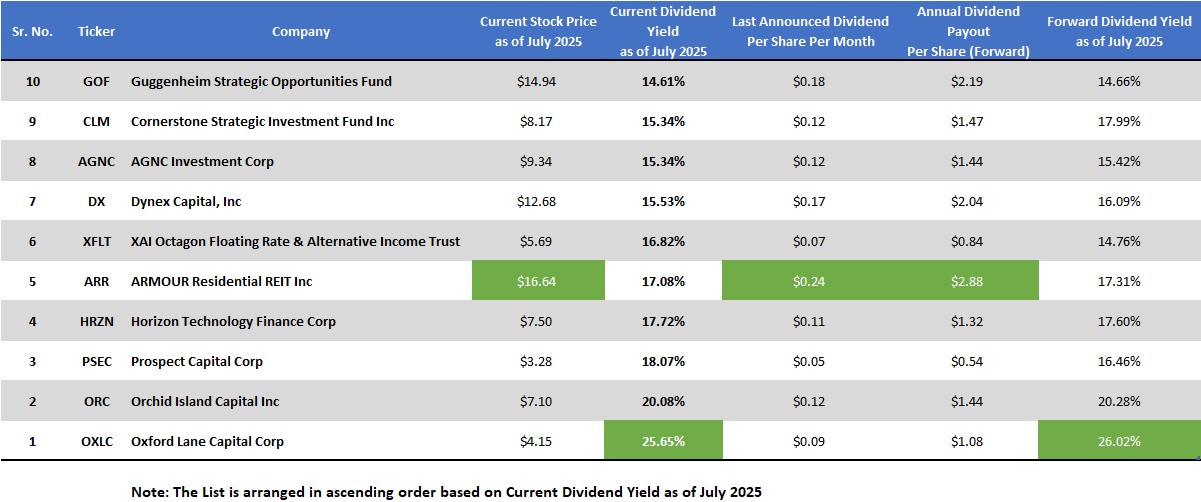

To identify the ten best monthly dividend stocks to buy in 2025, we screened for companies with a market capitalization of over $300 million and a consistent history of monthly dividend payments. We focused on dividend yield as a key metric, ensuring that all selected stocks offer attractive income potential. The final list is presented in ascending order of dividend yield, allowing investors to explore options across a range of income levels while maintaining a minimum standard of size and stability.

10 Best Monthly Dividend Stocks to Buy in 2025

10. Guggenheim Strategic Opportunities Fund (NYSE:GOF)

Dividend Yield: 14.61%

Our list of ten best monthly dividend stocks to buy in 2025 starts with Guggenheim Strategic Opportunities Fund (NYSE:GOF). Guggenheim Strategic Opportunities Fund is a closed end fund managed by Guggenheim Funds Investment Advisors, with a focus on both equities and fixed income investments worldwide. Since its inception in 2006, GOF has focused on generating consistent income through a balanced portfolio of global equities and fixed income securities and has become a go to income generating fund for yield focused investors.

What truly makes GOF stand out in 2025 is its impressive 14.61% forward dividend yield, far surpassing most income oriented funds. The fund delivers monthly dividends of $0.18, amounting to an annual forward payout of $2.19 per share. Despite a 5 year dividend growth rate of 0% and no increases in recent years, the fund has maintained steady monthly distributions, which is ideal for retirees and income focused investors seeking predictable cash flow.

GOF’s diversified portfolio includes value stocks, corporate bonds, structured finance, and even covered call strategies, offering exposure to both capital appreciation and income generation. The fund’s income strategy is further strengthened by targeting higher yielding fixed income assets while avoiding securities rated below CCC/Caa2.

With a market cap of $2.43 billion, GOF is a robust and liquid option for dividend seekers. For investors looking for high monthly income and a well managed portfolio, GOF earns a bullish spot on our list of the ten best monthly dividend stocks to buy in 2025.

09. Cornerstone Strategic Investment Fund, Inc. (NYSE:CLM)

Dividend Yield: 15.34%

Cornerstone Strategic Value Fund, Inc. (NYSE: CLM) is a closed end equity mutual fund managed by Cornerstone Advisors, LLC. Founded in 1987, the fund has a long standing track record of investing across global equity markets. It focuses on both value and growth stocks from diversified sectors, and also gains exposure through other closed end funds and ETFs. CLM aims to deliver consistent income while offering investors diversified equity exposure.

In 2025, CLM stands out for its eye catching forward dividend yield of 15.34%, making it one of the most aggressive income generators in the market. Investors receive monthly dividends of $0.12, totaling an annual payout of $1.47 per share. This frequency is ideal for those seeking steady, predictable income. Although the 5 year dividend growth rate is -9.97%, the fund has continued to pay monthly without interruption, a sign of commitment to shareholder returns.

With a market cap of $2.08 billion and a share price around $8.24, CLM offers a high yield income stream combined with affordability and liquidity. While dividend growth has been flat, the yield alone makes CLM a compelling pick.

08. AGNC Investment Corp. (NASDAQ:AGNC)

Dividend Yield: 15.34%

AGNC Investment Corp. (NASDAQ: AGNC) is a leading real estate investment trust (REIT) based in Bethesda, Maryland. Since its inception in 2008, the company has played a vital role in the U.S. housing finance system by providing private capital through investments in residential mortgage backed securities. These investments are typically backed by U.S. government agencies or government sponsored enterprises, which adds a layer of credit protection. AGNC operates under REIT rules, meaning it must distribute at least 90% of its taxable income to shareholders, making it a reliable income generator.

With a market cap of $9.58 billion and a strong presence in the mortgage REIT sector, AGNC is a go to stock for income focused investors in 2025. The company currently offers a massive forward dividend yield of 15.34%, paying out $1.44 per share annually, or $0.12 monthly. This consistent monthly payout is a major draw for investors looking for regular income, especially retirees and passive income seekers. While the 5 year dividend growth rate is -4.36% and there has been no recent dividend growth, the stability of monthly payments has remained intact.

AGNC maintains a reasonable payout ratio of 81.36%, which reflects a disciplined approach to dividend sustainability, especially notable given the volatility in interest rate markets. Citizens JMP analyst Trevor Cranston recently reiterated a Market Perform rating on AGNC but lowered the company's earnings estimates. The firm reduced its 2025 net spread plus dollar roll income per share forecast to $1.52 from $1.64, and also cut the 2026 estimate to $1.55 from $1.72, signaling modest earnings pressure ahead. Still, the stock’s consistent dividends and agency backed portfolio continue to make AGNC a top pick for monthly income in our list.

07. Dynex Capital, Inc. (NYSE:DX)

Dividend Yield: 15.53%

Dynex Capital, Inc. (NYSE: DX) is a mortgage real estate investment trust (mREIT) based in Glen Allen, Virginia. Founded in 1987, the company specializes in investing in mortgage backed securities (MBS), including both residential and commercial MBS, across agency and non agency segments. By focusing on MBS backed by entities like Fannie Mae and Freddie Mac, Dynex offers exposure to income generating assets with varying degrees of risk and return.

In 2025, Dynex Capital shines as a top monthly dividend pick, boasting a forward dividend yield of 15.93%, one of the highest among REITs. The company pays $0.17 per share monthly, translating to an impressive $2.04 annual payout. Although the 5 year dividend growth rate is slightly negative at 0.11%, Dynex has managed to increase its dividend in the last year, signaling a positive shift in income stability.

With a market cap of $1.37 billion and a stock price around $12.81, DX remains accessible for income focused investors. The company qualifies as a REIT for tax purposes and avoids federal income tax by distributing at least 90% of its taxable income to shareholders, a key feature that underpins its high yield strategy.

On July 3, JMP Securities reiterated a Market Perform rating on Dynex despite lowering earnings projections. The firm cut its 2025 earnings available for distribution (EAD) estimate to $1.66 from $2.03, an 18% decline, and reduced its 2026 estimate to $2.04 from $2.10. For Q2 2025, JMP projects EAD of $0.48. While this reflects a more cautious outlook, the continued rating suggests confidence in Dynex’s long term dividend paying capacity.

One point to note is the elevated payout ratio of 1,908%, which reflects the REIT's structure and earnings volatility typical of the mortgage sector. Still, with a long standing history and consistent monthly dividends, Dynex Capital is a bullish candidate for investors seeking high yield monthly income.

06. XAI Octagon Floating Rate & Alternative Income Trust (NYSE:XFLT)

Dividend Yield: 16.82%

XAI Octagon Floating Rate & Alternative Income Trust (NYSE:XFLT) is a closed end investment trust based in Chicago, Illinois. The fund is designed to provide attractive risk adjusted returns by investing in a diversified portfolio of floating rate loans, structured credit, and other alternative income generating assets. With its active management strategy, XFLT offers exposure to credit markets with the goal of delivering steady monthly income.

In 2025, XFLT has become an attractive choice for income focused investors thanks to its impressive forward dividend yield of 16.82%. At a share price of $5.69, the trust pays a monthly dividend of $0.07, translating to an annual payout of $0.84. Unlike many high yield funds, XFLT has shown signs of stability, with two consecutive years of dividend growth and a modest 5 year dividend growth rate of 2.72%, indicating management’s focus on sustainable income distribution.

With a market cap of $433.11 million, XFLT is a smaller but high performing option among monthly dividend stocks. Its alternative credit exposure and floating rate strategy also provide some protection against interest rate volatility, making it even more appealing in a shifting rate environment. The fund’s consistent dividend history and high yield make it a strong candidate for income investors. For those looking to generate passive monthly income in 2025, XFLT is a bullish pick.

05. ARMOUR Residential REIT, Inc. (NYSE:ARR)

Dividend Yield: 17.08%

At numbe ficve on our list of ten best monthly dividend stocks to buy in 2025 stands ARMOUR Residential REIT, Inc. (NYSE:ARR). ARMOUR Residential REIT, Inc. is a mortgage focused real estate investment trust (REIT) based in Vero Beach, Florida. Established in 2008, the company invests primarily in residential mortgage backed securities (MBS) that are backed or guaranteed by U.S. government agencies like Fannie Mae, Freddie Mac, and Ginnie Mae. As a REIT, ARMOUR avoids corporate income tax by distributing at least 90% of its taxable income to shareholders.

In 2025, ARMOUR offers an eye popping 17.08% forward dividend yield, making it one of the top income generating REITs on the market. The company pays a consistent monthly dividend of $0.24 per share, totaling an annual payout of $2.88. With a payout ratio of 77.42%, ARMOUR’s dividends appear sustainable despite some past reductions, the 5 year dividend growth rate sits at -18.68%, but the REIT has maintained payments for 16 consecutive years, which speaks to its reliability.

As of July 3, Citizens JMP reaffirmed its Market Perform rating on ARR, even while trimming its 2025 earnings estimate to $3.20 (down from $3.64). The firm also slightly lowered its 2026 estimate to $3.44. Despite the earnings revision, JMP noted that the stock appears fairly valued at 0.98x estimated book value.

With a market cap of $1.38 billion, strong dividend yield, and monthly income consistency, ARMOUR remains a solid bullish choice in our list of the ten best monthly dividend stocks to buy in 2025.

04. Horizon Technology Finance Corporation (NASDAQ:HRZN)

Dividend Yield: 17.72%

Horizon Technology Finance Corp. (HRZN) is a business development company (BDC) that provides secured loans to innovative, high growth companies backed by venture capital or private equity. Headquartered in the U.S., HRZN focuses on sectors like technology, life sciences, healthcare, cleantech, and sustainability, areas known for rapid growth and strong future potential. As an affiliate of Monroe Capital, HRZN benefits from deep industry expertise and a robust investment network.

In 2025, HRZN is turning heads with its incredible forward dividend yield of 17.72%, offering a compelling opportunity for income seeking investors. The company pays $0.11 per share monthly, totaling an annual payout of $1.32, a steady stream of cash flow ideal for retirees or anyone looking to generate passive income. While there’s been no recent dividend growth, HRZN maintains a 5 year dividend growth rate of 1.92%, indicating modest but consistent income performance.

With a market cap of $300.64 million and a payout ratio of 108.20%, the company is slightly overextended, but that’s not uncommon for BDCs, which are required to distribute most of their earnings. Horizon’s continued commitment to monthly payouts, even during market volatility, underscores management’s confidence.

03. Prospect Capital Corporation (NASDAQ:PSEC)

Dividend Yield: 18.07%

Prospect Capital Corporation (NASDAQ:PSEC) is a business development company (BDC) that specializes in lending to and investing in small to mid sized private companies across a wide range of industries. With a focus on everything from real estate and manufacturing to tech, healthcare, and energy, PSEC deploys capital through a variety of structures including senior debt, mezzanine financing, and private equity investments.

In 2025, Prospect Capital stands out with a staggering forward dividend yield of 18.07%, making it one of the highest yielding monthly payers in the market. The company distributes $0.05 per share monthly, totaling an annual payout of $0.54. With a payout ratio of 75.88%, the dividend is well supported by earnings. While the 5 year dividend growth rate is -3.58% and there hasn't been dividend growth in recent years, PSEC’s consistency is notable, it has paid dividends for 22 consecutive years, providing income stability even through volatile markets.

With a market cap of $1.5 billion, PSEC remains a solid player in the BDC space. Recently, on the M&A front, the company acquired consumer credit provider QC Holdings, Inc. in a $115 million all cash deal, reinforcing its strategy to grow through strategic investments. Even though the stock is currently trading near its 52 week low of $3.10, that may present a value opportunity for long term investors seeking high monthly income.

02. Orchid Island Capital, Inc. (NYSE:ORC)

Dividend Yield: 20.08%

Orchid Island Capital, Inc. (NYSE: ORC) is a specialty finance company based in Vero Beach, Florida. Since its incorporation in 2010, ORC has focused on investing in residential mortgage backed securities (RMBS) backed by single family home loans. These investments are Agency RMBS, meaning they’re issued or guaranteed by government sponsored entities like Fannie Mae or Freddie Mac, adding a layer of credit safety.

In 2025, Orchid Island Capital commands attention with a massive forward dividend yield of 20.08%, one of the highest among monthly payers. Investors receive $0.12 per share every month, totaling an annual dividend payout of $1.44. While the REIT hasn't shown dividend growth in recent years and has a 5 year dividend growth rate of -20.11%, its commitment to monthly distributions has remained steady, which appeals strongly to income seeking investors.

That said, the payout ratio stands at an elevated 2,116.4%, suggesting that current dividend levels are not fully covered by earnings, a common feature in mREITs that often rely on complex asset and leverage structures. Still, the trust’s ability to consistently deliver income, regardless of short term earnings volatility, makes it a notable income generator.

With a market cap of $764.85 million, ORC remains a smaller but impactful player in the mortgage REIT space. Its high yield structure and government backed mortgage portfolio make it an appealing option for dividend investors willing to balance risk with income.

For those prioritizing maximum monthly income, Orchid Island Capital deserves a bullish spot in our ten best monthly dividend stocks to buy in 2025.

01. Oxford Lane Capital Corp. (NASDAQ:OXLC)

Dividend Yield: 25.65%

Topping our list of ten best monthly dividend stocks to buy in 2025 is Oxford Lane Capital Corp. (NASDAQ:OXLC). Oxford Lane is a closed end fund managed by Oxford Lane Management LLC. Founded in 2010, the company focuses on investing in fixed income securities, primarily through securitization vehicles like collateralized loan obligations (CLOs). These CLOs hold senior secured loans made to companies with below investment grade or unrated debt, offering high income potential with managed risk.

In 2025, Oxford Lane stands out with a jaw dropping forward dividend yield of 25.65%, one of the highest in the market. At a share price of just $4.21, the fund delivers monthly dividends of $0.09, totaling an annual payout of $1.08 per share. For income investors, especially those seeking monthly cash flow, OXLC’s dividend policy is highly appealing.

Despite a 5 year dividend growth rate of 7.79%, the company has managed to grow its dividend for three consecutive years, signaling a positive trend and management’s confidence in the underlying portfolio. The fund’s structure as a closed end vehicle focused on high yield CLOs supports its ability to maintain large dividend distributions.

With a market cap of $1.91 billion, Oxford Lane is a sizable player in the alternative income space. Its focus on CLO equity and debt investments gives investors exposure to a diversified pool of high yield corporate loans, offering both income potential and portfolio diversification.

For investors seeking maximum monthly income, OXLC is a bullish pick in our list of ten best monthly dividend stocks.

Read Next:- 11 Dividend Stocks with Over 5% Yield That Could Rally in 2025

- 7 High Dividend Tech Stocks to Buy for Long Term Growth in 2025

Disclaimer: This article is for informational purposes only. See our full disclaimer. The article is originally published on TheRichStocks.com.