In this article we will take a closer look at ten red flags in Nike latest annual financial statements.

NIKE, Inc. (NYSE:NKE), the world’s leading athletic apparel brand, has long been a symbol of performance and innovation. However, its latest financial results for the fiscal year ending May 31, 2025, reveal that the iconic swoosh may be under more pressure than its stock price suggests. Despite a brief boost in investor sentiment following a trade deal between the U.S. and Vietnam, Nike’s annual financial statements raise serious concerns about its operational efficiency, margin health, and future growth trajectory.

While Nike’s stock jumped 4% after President Trump announced reduced tariffs on Vietnamese imports, down to 20% from a proposed 46%, the relief may be temporary. Vietnam remains the largest exporter of athletic footwear to the U.S., accounting for over 50% of imports by both volume and value. The deal also includes a 40% duty on transshipped goods, which could disrupt Nike’s finely tuned supply chains in Southeast Asia. According to CNBC July 3 report, although this agreement reduced short term uncertainty, it reflects a broader shift in global trade dynamics that will require Nike to be far more agile and cost conscious.

Compounding these external challenges are deeper internal concerns. Nike's gross margin dropped from 44.6% to 42.7% year over year, its lowest in five years. Inventory levels remain elevated, regional growth has slowed, and reliance on promotional activity is growing. These trends indicate rising inefficiencies and declining pricing power, key red flags for long term investors.

The bigger picture for Nike becomes even clearer when viewed through the lens of the State of Fashion 2025 report by McKinsey published in November last year. The report warns of a tough year ahead for apparel companies, citing slowing global demand, shifting consumer behaviors, and inflation driven price sensitivity. Only 20% of fashion executives surveyed expected improvement in consumer sentiment, while 39% predicted worsening conditions. The rise of low cost alternatives, or “dupes,” and booming resale and off price markets are eroding the dominance of legacy brands like Nike.

Additionally, McKinsey highlights that many fashion players are failing to adapt to a new landscape defined by regional divergence, climate pressures, and digital disruption. While Nike invests in innovation and sustainability, it now faces stiff competition from smaller, more agile brands that are increasingly winning over younger consumers, and even the growing over 50 “silver generation.”

Nike’s need to localize strategies, control costs, and redefine its premium value proposition has never been more urgent. As the brand battles external volatility and internal strains, stakeholders must look beyond headline earnings to understand the full scope of risks the company faces.

In this article, we unpack 10 key red flags in Nike’s most recent financial disclosures. Each signals deeper structural issues that could limit Nike’s growth potential in a fast changing global market. Whether you’re an investor, analyst, or retail industry observer, these insights will help you understand why Nike’s 2025 report deserves closer scrutiny, despite the stock market’s initial optimism.

Our approach to determining the red flags in Nike latest annual financial statements

To identify the red flags in Nike’s latest financial performance, we conducted a detailed review of the company’s Q4 and full year fiscal 2025 earnings report, including income statements, balance sheet data, and management commentary. Particular focus was placed on key financial metrics such as revenue growth, profit margins, segment performance, and cash flow trends. We also analyzed geographical breakdowns and year over year comparisons to highlight areas of operational weakness and financial deterioration. These red flags were selected based on their potential impact on investor sentiment and future earnings outlook.

10 Red Flags in Nike Latest Annual Financial Statements

10. Sharp Revenue Decline

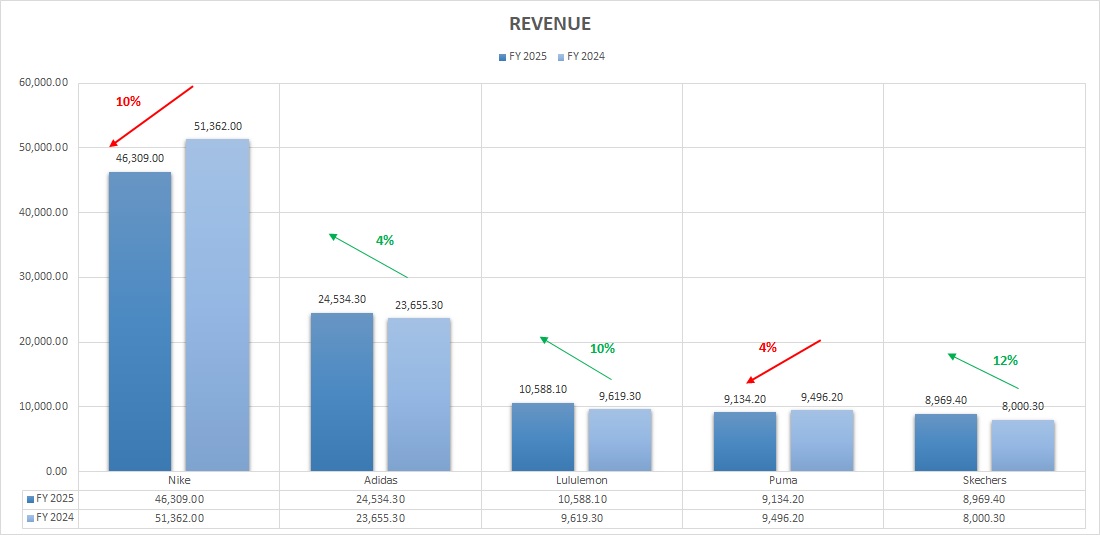

NIKE, Inc. (NYSE:NKE) experienced a significant decline in revenue for the fiscal year ending May 31, 2025. Total revenue dropped by approximately 10%, falling from $51.36 billion in FY2024 to $46.31 billion in FY2025. This decline was primarily driven by underperformance in two key sales channels: Nike Digital and Wholesale. The Nike Digital segment saw a steep 20% year over year decline, while revenue from the Wholesale channel decreased by 7%.

The sharp drop in digital sales raises important questions about shifting consumer preferences and Nike’s competitive positioning in the market. Why did Nike’s digital platform suffer such a substantial decline, especially in a retail environment increasingly driven by e commerce? This underperformance is particularly concerning given that many of Nike's closest rivals, including Adidas, Lululemon, Skechers, and Puma, reported year over year revenue growth during the same period. This divergence may suggest that consumers are gravitating toward alternative brands, signaling potential brand fatigue or execution issues within Nike’s digital strategy.

Data Source: SeekingAlpha

This drop in revenue raises more concerns as the company has increased its demand creation expense by 9% from $4,285 million in 2024 to $4,689 million in 2025. Despite this increase in marketing budget, the decline in revenue raises serious concerns about the company's ability to sell its products.

09. Gross Margin Pressure on Nike

NIKE, Inc. (NYSE:NKE) gross margin fell from 44.6% in FY2024 to 42.7% in FY2025, the lowest in the last five years. Gross margin is the percentage of sales left after subtracting the cost of goods sold. A lower margin means Nike is making less profit on each product it sells. The company says this decline was mainly due to higher discounts, weak pricing power, and ongoing inventory problems.

To sell older or extra stock, NIKE, Inc. (NYSE:NKE) had to offer more discounts, especially in North America and China. Discounting reduces how much money the company earns per item, pushing margins down. Inventory stayed high due to poor shipment timing, tariff issues, and investments in new distribution. Although company took steps to clean up excess stock, much of it was sold at lower prices through outlet stores and discount partners. Until inventory levels are fully under control, Nike’s profits are likely to stay under pressure.

08. Sharp Drop in Net Income of Nike

NIKE, Inc. (NYSE:NKE) net income fell sharply by 44% in FY 2025, dropping from $5.7 billion to $3.2 billion, marking the lowest profit in the past five years. This decline reflects intense pressure on the company’s bottom line, despite its efforts to manage costs. Several full year challenges contributed to this drop. Annual revenue declined by 10%, mainly due to weaker demand in North America and Greater China, and a steep fall in Nike Digital sales. Gross margins were squeezed by heavy discounting and inventory clearance, while supply chain costs remained high. Nike also increased marketing spending by 9% to boost demand, but these efforts didn’t generate enough revenue. Additionally, Nike’s classic footwear lines like Air Force 1 and Dunk saw over $1 billion in lost sales, hurting earnings during its product transition. Overall, this signals significant stress on Nike’s profitability.

07. Inventory Issues Persist for Nike

NIKE, Inc. (NYSE:NKE) faced ongoing inventory problems in FY 2025, with inventory levels staying flat compared to last year, despite a significant 10% drop in revenue. This mismatch suggests oversupply or slow moving stock that hasn’t been cleared effectively. In North America, the company had to offer higher discounts and accept more returns to liquidate aged inventory, which hurt profit margins. Inventory dollars and units actually increased due to new distribution investments, shipment delays, and the impact of new tariffs. In Greater China, NIKE, Inc. (NYSE:NKE) carried out deeper inventory resets with heavier discounts and supply cuts, while in APLA, cleanup efforts are still ongoing. Although EMEA showed slight improvement, inventory remained flat in dollar terms. Across regions, Nike had to raise its reserves for obsolete inventory, indicating expected losses on unsold goods. The company plans to continue selling excess stock through value stores and discount partners, which may cause further revenue pressure in the coming quarters.

06. Cash Burn

NIKE, Inc. (NYSE:NKE) cash and short term investments fell by $2.4 billion in FY 2025, dropping from $11.6 billion to $9.2 billion year over year. This is a concerning sign, especially as the company continued aggressive share buybacks and dividend payments despite weaker financial performance. The cash outflow was driven by multiple factors: stock repurchases, dividend payouts, debt repayments, and capital expenditures. These outflows exceeded the cash generated from business operations, signaling poor capital discipline during a challenging year. Over the past five years, Nike’s cash reserves have steadily declined from a high of $13.5 billion in FY 2021 to current levels, showing a weakening liquidity position. Maintaining high shareholder payouts while facing falling profits, lower revenue, and ongoing inventory issues may limit company’s financial flexibility going forward. This trend raises red flags about whether the company is prioritizing short term investor returns over long term financial health, especially in a period of slower growth and rising external costs.

05. EPS Down Over 40%

NIKE, Inc. (NYSE:NKE) diluted earnings per share (EPS) dropped by 42% in FY 2025, falling from $3.73 to $2.16. This is a serious red flag, as EPS is a key measure of profitability and heavily influences investor confidence and stock price. What makes this decline more concerning is that it occurred despite the company repurchasing $3.0 billion worth of shares, retiring 37.6 million shares as part of its four year, $18 billion buyback program approved in June 2022. Share buybacks typically reduce the number of outstanding shares, which should help increase EPS. However, the company’s profit dropped so much that even these aggressive buybacks couldn’t prevent the sharp decline. The falling EPS highlights deeper issues like lower earnings, margin pressure, and weaker business performance. If this trend continues, it could negatively impact investor sentiment and reduce Nike’s stock valuation, especially as the company uses cash to buy back shares instead of strengthening operations or investing in growth.

04. Converse Brand in Decline

NIKE, Inc. (NYSE:NKE) Converse brand is showing clear signs of trouble, with revenues falling 26% in Q4 and 19% for the full year in FY 2025. Total annual revenue dropped to $1.7 billion, with declines reported across all major territories. This broad based weakness signals deeper issues with the brand's performance and positioning in the global market. Converse, a wholly owned Nike subsidiary, is known for its lifestyle footwear and apparel, but it appears to be losing traction with consumers. A nearly 20% full year decline is significant and raises concerns about the brand’s future within Nike’s portfolio. In a time when Nike is trying to sharpen its focus and boost overall profitability, such a steep drop in Converse sales reflects poorly on brand portfolio health. If the brand continues to underperform, it could drag down Nike’s growth potential and limit diversification, especially as other parts of the business are already under pressure.

03. Nike Core Product and Regional Sales Declines

NIKE, Inc. (NYSE:NKE) faced major setbacks in FY 2025, with core product categories and key regional markets showing steep declines, a serious red flag for overall business health. Footwear revenue, which makes up the bulk of company’s sales, dropped 12% year over year, falling from $33.4 billion to $29.5 billion. Apparel sales also declined 6%, reflecting weaker demand and potential loss of consumer interest across global markets. These drops come despite heavy promotions and marketing efforts. Additionally, Greater China, a crucial growth market, saw a 13% revenue decline and a 31% drop in EBIT, even after deep inventory resets. Store traffic remains weak, and the path to recovery is uncertain. This regional slump adds to the pressure on Nike’s brand strategy. While equipment sales grew slightly by 6%, they represent a small portion of total revenue. Overall, the sharp declines across Nike’s key categories and geographies raise serious concerns about its ability to regain momentum and deliver sustainable growth.

02. 75 Basis Point Hit from Tariffs in FY26

NIKE, Inc. (NYSE:NKE) faces a significant cost headwind heading into FY 2026 due to newly imposed U.S. tariffs, which are expected to add $1 billion in incremental costs. This will result in a projected 75 basis point hit to gross margins, particularly concentrated in the first half of the year. While Nike is taking steps to mitigate the impact, such as shifting production away from China, negotiating with suppliers, and introducing targeted price increases starting Fall 2025, the pressure on margins remains a major concern. Despite having a globally diversified supply chain and long standing manufacturing partnerships, these tariffs introduce a structural cost burden that is difficult to fully offset in the short term. The company’s ability to preserve profitability while still investing in growth and brand recovery is now in question. If mitigation efforts fall short, Nike's future earnings and pricing power could be at risk, further weakening its financial position amid ongoing challenges.

01. Surge in Effective Tax Rate Amid Falling Profits

NIKE, Inc. (NYSE:NKE) effective tax rate jumped to 17.1% in FY25, up from 14.9% in FY24, despite a 44% drop in net income. This increase in tax burden during a period of declining profits is concerning. It reflects reduced tax benefits from stock based compensation and fewer one time credits, which helped in previous years. In a year when the company is already facing falling revenue, margin pressure, and higher inventory issues, this uptick in the tax rate further eats into bottom line profitability. The higher tax rate also means less flexibility for reinvestment or shareholder returns. Typically, companies try to optimize tax strategies in tough years, but Nike’s rising rate shows limited room for such adjustments. For investors, this is a red flag as it suggests diminishing efficiency in financial management and worsens the impact of already falling earnings.

Read Next:- UNH Stock Explained: Growth, Dividends & 2025 Outlook for UnitedHealth

- Lloyds Banking Group: Undervalued Titan in the Penny Stock Space

- Why DLocal (NASDAQ:DLO) Is a Top Fintech Stock to Buy Under $20 Now