In this article we will take a look at twelve best stocks under $10 to buy now.

Wall Street is heating up again as investors brace for another wave of earnings reports and macro shifts. On July 10, the S&P 500 approached record highs, bolstered by a well received $22 billion sale of 30 year U.S. Treasury bonds, indicating strong investor appetite for long duration assets despite ongoing deficit concerns, reported Bloomberg. Meanwhile, tech giants are driving sentiment, with Nvidia (NASDAQ:NVDA) surpassing a $4 trillion market cap and Tesla (NASDAQ:TSLA) spiking on news of Robotaxi expansion plans in California and Arizona.

However, it’s not all smooth sailing. Global trade tensions are escalating again, especially with President Trump threatening 50% tariffs on Brazilian goods. That volatility sent Brazil’s real currency on a wild ride, and companies like Embraer (NYSE:ERJ) took a hit on export fears. At the same time, job market data from Reuters shows U.S. weekly jobless claims unexpectedly dropped to a seven week low, signaling employer reluctance to lay off workers, even as hiring slows. The unemployment rate ticked down to 4.1% in June, but median job search duration rose to 10.1 weeks, pointing to a cooling yet resilient labor market.

Why Market Uncertainty Is Creating Opportunity in the Best Stocks Under $10

So what does all this mean for stock pickers? In an environment marked by uncertain trade policies, cautious hiring, and shifting monetary expectations, value becomes king. That’s where the best stocks under $10 come into play, offering affordable exposure to companies with strong fundamentals, earnings growth, and analyst support.

Our Data Backed Picks: 12 Best Stocks Under $10 to Buy Now

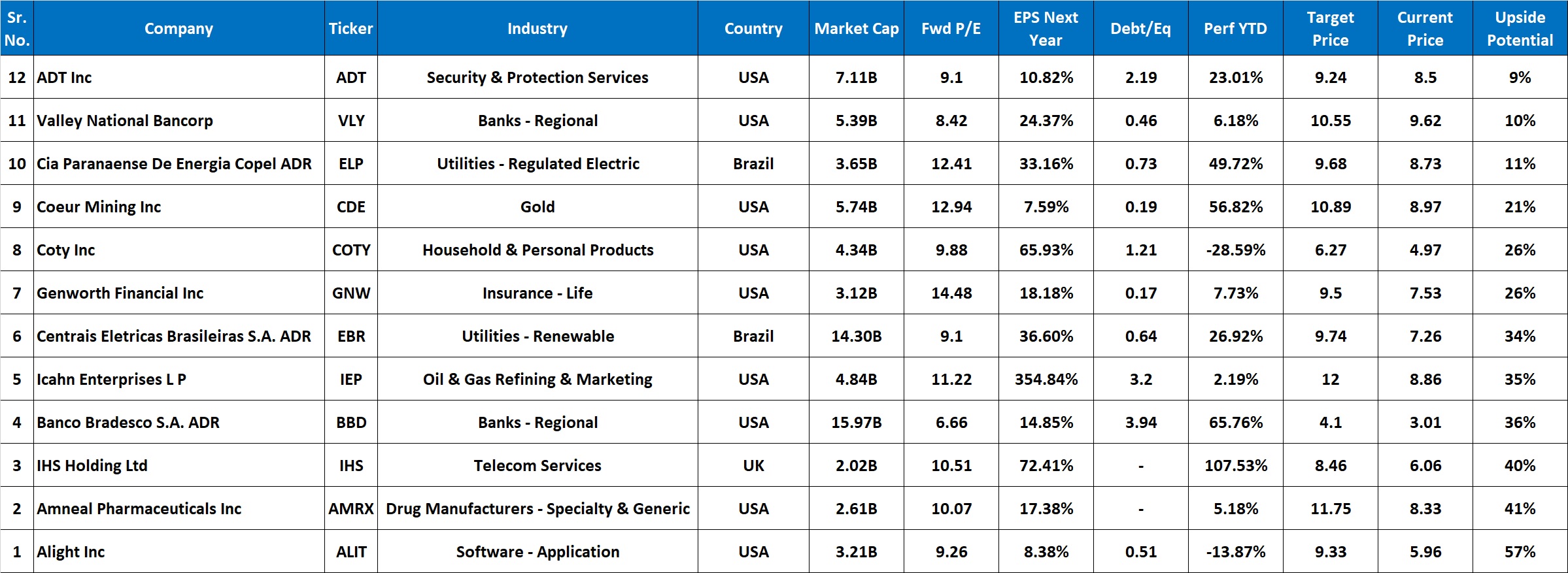

To help you navigate this opportunity rich, data heavy landscape, we’ve compiled a list of 12 best stocks under $10 to buy now. Each stock in this list meets specific criteria: a forward P/E under 15, positive expected EPS growth, a market cap above $2 billion, and a “Buy” or better rating from analysts. We also made sure they offer upside based on average price targets.

From security and telecom to energy, pharma, and financials, this list covers it all. Whether you are looking to diversify or uncover undervalued gems before the rest of the market catches on, these low priced, high potential stocks are worth a closer look.

Our Approach to Identifying the Best Stocks Under $10

To compile our list of the 12 best stocks under $10 to buy now, we focused on fundamentally sound, undervalued companies with strong upside potential. Specifically, we screened for stocks trading below $10 per share that meet the following criteria: a forward price to earnings (P/E) ratio under 15, positive expected earnings per share (EPS) growth for the next year, a market capitalization above $2 billion, and a “Buy” or better consensus recommendation from analysts. Additionally, we only included stocks with a positive upside based on the average analyst price target compared to the current market price. This data driven approach ensures the list highlights attractively priced stocks that not only have room to run but also exhibit improving fundamentals and analyst confidence.

12 Best Stocks Under $10 To Buy Now

12. ADT Inc. (NYSE:ADT)

Upside Potential as of July 10: 9%

Earnings Growth for the next Year: 10.82%

Forward P/E Ratio as of July 10: 9.1

Looking for a cheap stock with real earnings, consistent growth, and a solid dividend? ADT Inc. might be your pick. With a forward P/E of just 9.1 and expected earnings growth of 10.82% over the next year, this stock is trading well below its fundamental value, and still offers a 9% upside as of July 10.

ADT Inc. (NYSE:ADT) is a leading provider of security, automation, and smart home solutions across the U.S. It offers everything from burglar alarms and surveillance systems to smart locks and emergency response devices. The company also integrates its services with the Google Nest ecosystem, allowing homeowners to control everything through a single app.

The company posted a strong start to 2025, growing total revenue 7% year over year and achieving record customer retention with attrition dropping to 12.6%. EPS came in at $0.21, beating analyst expectations, while free cash flow more than doubled. Recurring Monthly Revenue reached a record $360 million, driven by high adoption of its new ADT Plus platform.

ADT’s investment in AI driven support and remote diagnostics is reducing service costs and improving efficiency. It’s also rewarding shareholders, $445 million was returned via dividends and buybacks in Q1 alone.

Risks include tariff related cost pressures on imported hardware, though ADT Inc. (NYSE:ADT) is actively pursuing mitigation strategies like supplier renegotiations and potential price adjustments. Still, with a long standing brand, strong fundamentals, and growing demand for home security, ADT looks like a compelling value pick for 2025.

11. Valley National Bancorp (NASDAQ:VLY)

Upside Potential as of July 10: 10%

Earnings Growth for the next Year: 24.27%

Forward P/E Ratio as of July 10: 8.42

Trading under $10, Valley National Bancorp (NASDAQ:VLY) offers a rare blend of solid fundamentals, low valuation, and promising upside potential. As of July 10, the stock has a forward P/E ratio of just 8.42 and projected earnings growth of 24.27% over the next year. That kind of growth at this price point is hard to ignore, especially with a potential upside of 10%.

Valley National Bancorp (NASDAQ:VLY) is a regional bank that serves both consumer and commercial clients across a diversified portfolio of lending and deposit services. The bank focuses on commercial real estate, small business lending, and indirect auto loans, giving it a solid foundation in interest earning assets.

Despite a modest Q1 miss on earnings (EPS of $0.18 vs. $0.19 expected), the bank reported $106 million in net income and made notable progress in cost reduction and deposit growth. Core customer deposits rose by $600 million, helping pay off $700 million in higher cost brokered deposits. This shift contributed to improved net interest margin, which increased for the fourth straight quarter.

Loan loss provisions and net charge offs both declined significantly from the previous quarter, pointing to improved asset quality. Valley also raised its allowance coverage to 1.22%, the highest in five years. Management expects steady loan growth, modest margin improvement, and low expense growth for the rest of 2025.

The key risk is slower than expected loan demand and continued margin compression from competition. However, Valley National Bancorp (NASDAQ:VLY) low valuation, improving fundamentals, and strong capital base make it one of the best value picks under $10.

10. Companhia Paranaense de Energia - COPEL (NYSE:ELP)

Upside Potential as of July 10: 11%

Earnings Growth for the next Year: 33.16%

Forward P/E Ratio as of July 10: 12.41

Looking for a utility stock with growth potential and reliable dividends? Companhia Paranaense de Energia - COPEL (NYSE:ELP) stands out with 33.16% projected earnings growth and an attractive forward P/E of 12.41. With an upside potential of 11% as of July 10, ELP is gaining attention as one of the best stocks under $10.

COPEL is a Brazilian electric utility that generates, transmits, distributes, and sells electricity across various customer segments. It also operates hydro, wind, and thermal plants and distributes piped natural gas. The company’s operations are spread across several Brazilian states, making it a key regional energy player.

In Q1 2025, COPEL delivered strong results. EBITDA grew 13% year over year to BRL1.5 billion, with solid contributions from both its generation and distribution businesses. Recurring net income rose 6.4%, and the company announced a dividend payout exceeding 86% for 2024, offering a yield near 9%. Its new dividend policy guarantees at least a 75% payout, providing income predictability.

Leverage is well managed at 2.3 times net debt to EBITDA, below the 2.8 target. Capital expenditures reached BRL678 million in the quarter, with most directed toward improving distribution infrastructure. COPEL is also capitalizing on energy price volatility through strategic trading contracts and regional market positioning.

Risks include exposure to macroeconomic uncertainty, interest rate fluctuations, and energy price swings. However, with strong fundamentals, efficient capital allocation, and a clear strategic roadmap, Companhia Paranaense de Energia - COPEL (NYSE:ELP) is a solid pick for long term investors hunting value in the under $10 range.

09. Coeur Mining, Inc. (NYSE:CDE)

Upside Potential as of July 10: 21%

Earnings Growth for the next Year: 7.59%

Forward P/E Ratio as of July 10: 12.94

If you’re hunting for one of the best stocks under $10 with serious upside, Coeur Mining, Inc. (NYSE:CDE) deserves your attention. With gold and silver prices rising and a 21% upside potential as of July 10, Coeur is making a strong case as a turnaround story with powerful fundamentals.

Coeur Mining is a U.S. based gold and silver producer with operations across North America, including key assets like Las Chispas in Mexico, Rochester in Nevada, and Kensington in Alaska. The company explores and sells gold, silver, and base metals to smelters and refiners under long term agreements.

After years of investment, Coeur Mining, Inc. (NYSE:CDE) is finally reaping the rewards. In Q1 2025, it posted its fourth consecutive quarter of net income and third straight quarter of positive free cash flow. Adjusted EBITDA hit $149 million on revenue of $360 million, pushing the margin to an impressive 41%, nearly double the prior year. Management expects full year EBITDA to exceed $700 million and free cash flow to top $300 million.

The addition of the high grade, low cost Las Chispas mine has been a game changer. Coupled with Rochester’s expansion and steady performance across the portfolio, Coeur is well diversified, with no single asset contributing more than 25% of revenue. The company has also reduced debt by $130 million, with a goal to eliminate its revolving credit facility by Q3 2025.

On July 1, Roth Capital raised its price target on Coeur Mining, Inc. (NYSE:CDE) to $12 from $10 while maintaining a Buy rating. The upgrade comes as Roth updates its mining sector outlook based on sharply higher gold and silver price forecasts for the rest of 2025. Higher projected precious metal prices are expected to significantly boost Coeur’s earnings potential.

Risks for the company include commodity price volatility, integration of new assets, and higher non cash expenses like amortization and deferred taxes. Still, with a leaner balance sheet, rising output, and a $75 million share repurchase plan, Coeur Mining, Inc. (NYSE:CDE) is a compelling pick for investors looking for value and growth in the mining sector.

08. Coty Inc. (NYSE:COTY)

Upside Potential as of July 10: 26%

Earnings Growth for the next Year: 65.93%

Forward P/E Ratio as of July 10: 9.88

The number eighth spot on our list of 12 best stocks under $10 to buy now is held by Coty Inc. (NYSE:COTY). This beauty giant is not just a household name but a global player undergoing a strategic transformation, with analysts seeing a 26% upside from its current price of $4.97 to a target of $6.27.

Coty Inc. (NYSE:COTY) is a leading manufacturer and marketer of beauty products, operating across two major segments: Prestige and Consumer Beauty. Its high end lineup includes globally recognized fragrance brands like Gucci, Marc Jacobs, and Burberry. On the mass market side, Coty owns iconic names such as CoverGirl, Rimmel, and Sally Hansen, distributing through drugstores, e commerce, and supermarkets worldwide.

Financially, Coty is making notable progress. The company recently posted its fourth consecutive quarter of profitability and continues to generate solid free cash flow. While Q4 guidance indicates a temporary dip due to strategic inventory cleanups and pressures in the Asian market, management expects a strong recovery in fiscal 2026. They’re also prepping major product launches to fuel growth. Coty's revenue stream is well diversified, and the company is actively shifting investment toward fast growing and higher margin categories like mass fragrances.

Risks remain, including softness in the color cosmetics segment and global economic uncertainties. Still, Coty Inc. (NYSE:COTY) balanced brand portfolio, disciplined cost management, and innovation pipeline position it well for long term gains. With shares still trading under $5 and a buy rating from analysts, Coty stands out as a strong value pick among the best stocks under $10.

07. Genworth Financial, Inc. (NYSE:GNW)

Upside Potential as of July 10: 26%

Earnings Growth for the next Year: 18.18%

Forward P/E Ratio as of July 10: 14.48

Looking for a deeply undervalued stock with strong fundamentals and growth potential? Genworth Financial, Inc. (NYSE:GNW) could be one of the best stocks under $10 to buy now. Priced around $7.53 as of July 10, the stock offers a 26% upside based on its target price of $9.5 and has an earnings growth forecast of 18.18% for next year.

Genworth Financial, Inc. (NYSE:GNW) is a diversified insurance company with operations across mortgage insurance, long term care insurance, and life and annuity products. Its Enact segment provides mortgage insurance and underwriting services. The company also offers long term care insurance to help manage rising elder care costs and retirement solutions through life and annuity products.

On June 17, Keefe Bruyette upgraded Genworth Financial, Inc. (NYSE:GNW) to Outperform from Market Perform and raised its price target to $9, up from $8.50. The upgrade is based on the potential recovery of $500 million, or about $1.25 per share, from a lawsuit involving Genworth’s former European payment protection insurance business sold to AXA. A ruling on the case, which also involves a countersuit between AXA and Santander, is expected by mid to late summer. If successful, the recovery could represent 15% to 20% of Genworth’s total market value. Keefe also notes that Genworth currently trades at a 22% discount to its implied sum of the parts valuation even without factoring in any legal recovery. This is wider than its average discount of 15% since mid 2023, suggesting attractive upside for investors.

From a financial perspective, Genworth Financial, Inc. (NYSE:GNW) is delivering strong results. It reported $51 million in adjusted operating income in Q1 2025, with its Enact segment contributing $137 million. The forward P/E ratio stands at just 14.48, suggesting the stock remains attractively priced. Genworth’s balance sheet is solid, with $211 million in cash and liquid assets and a low holding company debt of $790 million, offering flexibility in a volatile market. Enact’s consistent performance also enabled a 14% dividend hike and a new $350 million share buyback plan.

One of Genworth Financial, Inc. (NYSE:GNW) most promising growth drivers is CareScout, its long term care services network. It’s expanding rapidly and expected to generate meaningful revenue and cost savings over time. However, risks remain. The company still faces headwinds in its legacy life and annuity segments and is exposed to economic shifts that may affect its insurance portfolio.

Still, with rising demand for long term care solutions and strong fundamentals, Genworth Financial, Inc. (NYSE:GNW) is a compelling choice among the best stocks under $10 for value focused investors.

06. Centrais Elétricas Brasileiras S.A. - Eletrobrás (NYSE:EBR)

Upside Potential as of July 10: 34%

Earnings Growth for the next Year: 36.60%

Forward P/E Ratio as of July 10: 9.1

One of the best stocks under $10 could be hiding in plain sight. Centrais Elétricas Brasileiras S.A. - Eletrobrás (NYSE:EBR), Brazil’s largest power utility, is quietly positioning itself for long term growth. With a current share price of $7.26 and a price target of $9.74, the stock offers a 34% upside potential as of July 10.

Centrais Elétricas Brasileiras S.A. - Eletrobrás (NYSE:EBR) is a major electricity provider in Brazil, operating across generation, transmission, and trading. The company manages a vast portfolio of assets, including 44 hydroelectric plants, five thermal facilities, two nuclear reactors, and over 66,000 kilometers of transmission lines. Its shift toward clean energy, through wind, solar, and hydro, is a key part of its strategy to reach net zero by 2030.

Despite a weak Q1 2025 earnings report, with EPS of $0.07 missing expectations of $0.16, Eletrobrás continues to make important strides. The company reduced operational costs by 8% year over year and improved energy trading performance, increasing its free market exposure by 35%. It also received $2.9 billion in cash from selling thermal plants, strengthening its balance sheet while aligning with sustainability goals.

From a valuation perspective, Eletrobrás remains attractive. With a stock price under $10, a solid mix of regulated cash flows, and a strong focus on decarbonization, the upside looks compelling. Its diversified generation mix and ongoing infrastructure expansion, including progress on the Angra nuclear plant and key transmission projects, also support long term earnings growth.

However, there are risks. Energy price mismatches across regions and regulatory changes in Brazil could affect profitability. But management has acknowledged past missteps in energy trading and is adjusting strategy to reduce exposure going forward.

For investors seeking one of the best stocks under $10 with a clean energy tilt, Centrais Elétricas Brasileiras S.A. - Eletrobrás (NYSE:EBR) is worth a closer look.

05. Icahn Enterprises L.P. (NASDAQ:IEP)

Upside Potential as of July 10: 35%

Earnings Growth for the next Year: 354.84%

Forward P/E Ratio as of July 10: 11.22

Icahn Enterprises L.P. (NASDAQ:IEP) is a multi sector conglomerate led by legendary investor Carl Icahn. The company operates across a wide range of industries including energy, automotive, real estate, food packaging, pharmaceuticals, and more. Its investment arm manages proprietary capital through private funds and also provides advisory services. With a 35% upside based on a price target of $9.80 versus its current price near $7.25, this diversified holding company could surprise investors as its earnings rebound in 2025.

Although Icahn Enterprises L.P. (NASDAQ:IEP) missed Q1 2025 earnings expectations with a loss of $0.79 per share, there’s more to the story. The company expects earnings growth of 354% over the next year, showing a strong turnaround potential. Its forward P/E ratio stands at 11.22, which is attractive given the expected growth. Management is actively restructuring underperforming businesses like the automotive segment, closing unprofitable stores while investing in better locations. Meanwhile, its energy division is recovering as refinery operations stabilize and margins improve.

Icahn Enterprises L.P. (NASDAQ:IEP) also holds over $3.8 billion in cash and fund investments, providing a strong liquidity base to take advantage of future opportunities. The company continues to pay a $0.50 per unit quarterly distribution, which is attractive for income focused investors.

Risks remain, particularly around market volatility, weak segments like automotive, and exposure to regulatory outcomes in its energy operations. However, with a solid balance sheet, long term asset value, and active restructuring efforts underway, Icahn Enterprises L.P. (NASDAQ:IEP) offers an appealing risk reward profile. For U.S. investors seeking the best stocks under $10 with high upside and strong fundamentals, Icahn Enterprises deserves serious consideration.

04. Banco Bradesco S.A. (NYSE:BBD)

Upside Potential as of July 10: 36%

Earnings Growth for the next Year: 14.85%

Forward P/E Ratio as of July 10: 6.66

Looking for international exposure among the best stocks under $10? Banco Bradesco S.A. (NYSE:BBD), a leading Brazilian financial institution, is quietly building momentum with strong fundamentals, improving profitability, and a 36% upside from current levels.

Founded in 1943, Banco Bradesco S.A. (NYSE:BBD) offers a wide range of banking and insurance services to individuals and businesses in Brazil and beyond. The bank operates two main divisions: Banking and Insurance, providing everything from savings and checking accounts to auto loans, mortgages, credit cards, pensions, and investment products.

In Q1 2025, Bradesco delivered impressive results. Recurring net income surged over 39% year over year to nearly 5.9 billion BRL, with a return on average equity (ROAE) of 14.4%. Total revenue rose 15%, driven by solid loan growth, strong insurance performance, and higher net interest income (NII). The bank’s fee and commission income increased over 10%, while its insurance division grew 32.7%, supported by strong distribution and client engagement.

Banco Bradesco S.A. (NYSE:BBD) loan book is healthy and expanding, especially in low risk segments like payroll loans, real estate, and agriculture. Over 50% of its portfolio is collateralized, and delinquency remains low. The bank is also using AI and data analytics to manage risk more efficiently and scale growth. It closed over 1,400 underperforming branches, reduced expenses, and ramped up digital capabilities, which is boosting margins.

Risks include currency volatility and Brazil’s shifting interest rate environment. But with disciplined cost control, robust capital ratios, and consistent earnings momentum, Bradesco offers attractive value.

For long term investors seeking financial stability and growth potential, Banco Bradesco S.A. (NYSE:BBD) is a compelling pick among the best stocks under $10.

03. IHS Holding Limited (NYSE:IHS)

Upside Potential as of July 10: 40%

Earnings Growth for the next Year: 72.41%

Forward P/E Ratio as of July 10: 10.51

IHS Holding Limited (NYSE:IHS) is flying under the radar despite operating critical telecom infrastructure across emerging markets. Priced under $10, it offers investors a rare combination of strong earnings growth, improving margins, and solid cash flow. With a forward P/E of just 10.5 and a projected 72% jump in earnings next year, the stock stands out as one of the best stocks under $10 to consider now.

Founded in 2001 and headquartered in London, IHS Holding Limited (NYSE:IHS) develops, owns, and operates shared telecom towers and fiber networks across Africa, Latin America, and the Middle East. It serves mobile network operators, internet providers, and large enterprises through long term lease agreements, making its cash flows predictable and recurring.

The company reported a robust start to 2025, with adjusted EBITDA reaching $253 million and a margin of 57.5%, up over 13 percentage points from a year ago. Organic revenue growth came in at 26%, supported by increased tower leasing, inflation adjusted contracts, and disciplined capital spending. Free cash flow surged by 248% year over year, while CapEx fell 18%, reflecting a shift toward capital efficiency.

Management has taken steps to reduce leverage, bringing the net debt to EBITDA ratio down to 3.4x. Proceeds from a recently announced $274.5 million tower sale in Rwanda should further strengthen the balance sheet.

However, investors should be mindful of FX risks in key markets like Nigeria and tenant churn tied to contract renewals. Still, IHS Holding Limited (NYSE:IHS) essential infrastructure and improving financials make it a compelling value play among small cap telecom names.

02. Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX)

Upside Potential as of July 10: 41%

Earnings Growth for the next Year: 17.38%

Forward P/E Ratio as of July 10: 10.07

Few investors realize that a pharmaceutical powerhouse is quietly trading for just $8.33 a share. That company is Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX), and analysts believe it could climb 41% based on a price target of $11.75. For those searching for the best stocks under $10, Amneal stands out as a rare blend of affordability, innovation, and profitability.

Headquartered in New Jersey, Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX) develops and manufactures a wide range of medicines, from generic pills and injectables to cutting edge specialty drugs for conditions like Parkinson’s and hypothyroidism. It also operates AvKARE, a government focused division supplying medical products to agencies like the Department of Veterans Affairs.

On June 6, Goldman Sachs analyst Matt Dellatorre initiated coverage on Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX) with a Buy rating and a $12 price target, signaling strong upside from current levels. According to the firm, Amneal is well placed to outperform, supported by solid execution and a diverse product pipeline. Goldman expects Amneal’s generics segment to remain the core driver of EBITDA growth, fueled by upcoming launches in biosimilars and sterile injectables. The analyst highlighted the company's momentum across all business segments and believes there is upside potential to consensus estimates based on its expanding portfolio and execution strength.

The numbers speak volumes. In Q1 2025, Amneal reported $695 million in revenue (up 5% year over year), while adjusted EBITDA rose 12% to $170 million. Its adjusted earnings per share jumped 50% to $0.21. The company boasts strong gross margins at 43.1% and maintains a manageable net leverage ratio of 3.9x.

Growth drivers include the successful rollout of CREXONT, a new Parkinson’s drug already gaining market share, and an expanding pipeline of biosimilars. Its partnership in the GLP 1 space for weight loss treatments also holds long term promise.

Risks include pricing pressure across generics and execution challenges on new product launches, but the company's scale, U.S. based manufacturing advantage, and innovation pipeline provide strong support.

For investors seeking value in healthcare, Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX) is one of the best stocks under $10 to watch right now.

01. Alight, Inc. (NYSE:ALIT)

Upside Potential as of July 10: 57%

Earnings Growth for the next Year: 8.38%

Forward P/E Ratio as of July 10: 9.26

At the top of our list of best stocks under $10 to buy now stands Alight, Inc. (NYSE:ALIT). Amid the rush toward AI driven workplace solutions, Alight, Inc. (NYSE:ALIT) is quietly positioning itself as a dominant force. With a 57% potential upside and expected earnings growth of over 8% next year, this overlooked tech enabled services firm is gaining traction among institutional investors.

Based in Chicago, Alight delivers cloud based employee benefits and wellness solutions through its AI powered Alight Worklife platform. It supports employers with integrated services including healthcare navigation, retirement planning, leave management, and financial wellness, helping both companies and employees manage health and wealth with simplicity and transparency.

Alight, Inc. (NYSE:ALIT) posted Q1 2025 revenue of $548 million and adjusted EBITDA of $118 million, landing at the high end of guidance. Recurring revenue made up 95% of the total, reflecting a stable, long term business model. With 92% of its expected 2025 revenue already under contract and free cash flow projected to reach $285 million, Alight is building financial momentum. The company also returned $41 million to shareholders through dividends and buybacks in the last quarter alone.

Key growth drivers include increasing demand for AI driven benefits platforms and strong client retention. Companies like Starbucks and US Foods have renewed contracts, signaling confidence in Alight, Inc. (NYSE:ALIT) services. Strategic cost saving measures and a restructuring plan are also expected to drive margin expansion.

Risks include delays in project revenue and exposure to market driven fee fluctuations in its wealth advisory segment. However, with solid fundamentals and long term contracts in place, Alight, Inc. (NYSE:ALIT) deserves a spot on any list of the best stocks under $10 for 2025.

Read Next:

- 7 Best Real Estate Stocks To Buy Now

- 7 High Dividend Tech Stocks to Buy for Long Term Growth in 2025

Disclaimer: This article is for informational purposes only. See our full disclaimer. The article is originally published on TheRichStocks.com.