In this article we will take a look at top three trending stocks to watch right now in august 2025.

The stock market is kicking off the week in a cautious mood as all eyes turn to July’s U.S. Consumer Price Index (CPI) report. This inflation data could play a big role in what the Federal Reserve does next with interest rates. Reuters reports that economists expect CPI to rise 0.2% from June and 2.8% from last year. Core CPI, which leaves out food and energy, is forecast to climb 0.3% for the month, its largest increase since January.

The numbers come at a time when some experts are questioning the accuracy of U.S. economic reports. Budget cuts at the Bureau of Labor Statistics have forced the agency to rely more on estimates instead of directly collected data, adding more uncertainty to inflation readings.

Markets have been fairly quiet ahead of the release. Bloomberg says S&P 500 futures are up about 0.2%, while 10 year U.S. Treasury yields have slipped to 4.28%. Traders are watching closely because there’s now almost an 87% chance, according to CME’s FedWatch Tool, that the Fed will cut rates in September.

Meanwhile, trade tensions between the U.S. and China remain a wild card. CNBC reports that President Donald Trump has extended the 90 day pause on higher tariffs, avoiding an immediate spike in duties. While this helps in the short term, analysts warn that the effects of current tariffs could still hit the economy in the months ahead.

Individual stocks are also making big moves. Celanese, a specialty chemicals company, plunged 15% after giving a weaker outlook for the third quarter despite solid Q2 results. On the other hand, Sinclair Broadcast Group jumped 27% after announcing it’s reviewing strategic options, which could include a merger or a spin off.

Against this backdrop of inflation worries, potential rate cuts, and company specific news, certain stocks are standing out from the crowd. In this article, we’ll look at the top three trending stocks to watch in August 2025. Each one is in the spotlight for a clear reason, whether it’s an earnings beat, a big corporate move, or sector momentum, and could see more action in the weeks ahead.

Our Methodology for Selecting the Top 3 Trending Stocks

To identify the top trending stocks for this list, we analyzed Google Trends data from August 4 to August 10, 2025. Search volume was used as the primary metric to shortlist stocks generating the most investor interest during the week. We then arranged the selected stocks in ascending order of search volume.

Top 3 Trending Stocks to Watch Right Now In August 2025

03. Advanced Micro Devices, Inc. (NASDAQ:AMD)

Search Volume on Google from 4 to 10 August: 100K+

Advanced Micro Devices, Inc. (NASDAQ:AMD) is one of the top trending stocks in August 2025 on google after reporting strong second quarter results that beat Wall Street expectations. The company posted earnings per share of $0.48 and record revenue of $7.7 billion, up 32% from last year. Advanced Micro Devices, Inc. (NASDAQ:AMD) growth is being driven by strong sales of its computer chips for both personal and business use. Its high performance processors are in demand from big tech companies, cloud providers, and gaming hardware makers. Major names like Google and Oracle are using AMD chips to power faster, more efficient computing services, which is a big win for the company.

Another reason Advanced Micro Devices, Inc. (NASDAQ:AMD) is trending is its push into artificial intelligence (AI). The company launched a new line of AI chips, the Instinct MI350 series, which are already being used by large customers. Advanced Micro Devices, Inc. (NASDAQ:AMD) is also working on its next generation of AI products, set to launch in 2026, which it claims will deliver huge performance improvements.

In the gaming market, Advanced Micro Devices, Inc. (NASDAQ:AMD) is partnering with Microsoft and Sony to develop custom chips for future consoles. Its Radeon graphics cards are also selling well among PC gamers, adding another boost to revenue.

Investors are watching Advanced Micro Devices, Inc. (NASDAQ:AMD) closely because it’s performing well across multiple markets, cloud computing, AI, gaming, and personal computers. The company also gave an upbeat forecast for the next quarter, suggesting that its growth momentum will continue.

On August 6, DZ BANK AG analyst Ingo Wermann upgraded Advanced Micro Devices, Inc. (NASDAQ:AMD) to a hold rating and raised the stock’s target price from $150 to $165. Also on the same day, Deutsche Bank analyst Ross Seymore increased the firm’s price target on Advanced Micro Devices (AMD) from $130 to $150 while maintaining a Hold rating on the stock.

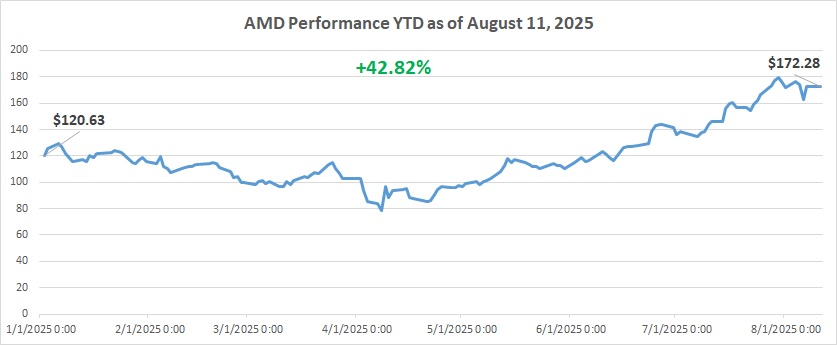

Advanced Micro Devices, Inc. (NASDAQ:AMD) has delivered a standout performance in 2025, with the stock up 42.82% year to date as of August 11, far outpacing the S&P 500’s gain of 8.36% over the same period.

With a strong earnings beat, new product launches, and partnerships with some of the biggest names in tech, it’s no surprise Advanced Micro Devices, Inc. (NASDAQ:AMD) has become one of the most searched and talked about trending stocks this month.

02. Intel Corporation (NASDAQ:INTC)

Search Volume on Google from 4 to 10 August: 100k+

Intel Corporation (NASDAQ:INTC) is one of August’s most talked about trending stocks after releasing its Q2 2025 earnings. The company reported a loss of $0.10 per share, missing analyst expectations of $0.012. However, revenue came in strong at $12.9 billion, beating the high end of guidance thanks to steady demand in personal computing and data center markets.

CEO Lip Bu Tan outlined a major restructuring plan aimed at making Intel Corporation (NASDAQ:INTC) leaner and more efficient. The company has reduced management layers by about 50% and is targeting a year end workforce of 75,000. These changes are designed to cut costs, speed up decision making, and improve execution.

Intel Corporation (NASDAQ:INTC) is also taking a new approach to its foundry business, focusing on building capacity only when there is confirmed customer demand. This includes halting projects in Germany and Poland and slowing construction in Ohio to match market needs.

On the product side, Intel Corporation (NASDAQ:INTC) is making progress on its advanced Intel 18A and 14A process nodes. The Panther Lake chip launch is scheduled for later this year, which could strengthen Intel’s position in the notebook market. In servers, its Granite Rapids and Xeon 6 processors are seeing strong adoption, especially in AI workloads, including partnerships with NVIDIA and Imperial College London.

Financially, Intel Corporation (NASDAQ:INTC) is still facing profitability challenges due to restructuring and impairment charges. But with $21.2 billion in liquidity and a focus on reducing debt, the company is positioning itself for a long term turnaround.

On August 11, President Trump met with Intel CEO Lip-Bu Tan, just days after publicly calling for his resignation over alleged ties to Chinese firms. Following the meeting, Trump praised Tan, calling their discussion very interesting, as Intel reaffirmed its commitment to strengthening U.S. technology leadership. Intel shares rose 3% in extended trading after news of the meeting.

From analysts standpoint, on July 25, JP Morgan analyst Harlan Sur reaffirmed his Underweight rating on Intel Corporation (NASDAQ:INTC), keeping the stance unchanged from the previous review. However, he raised the price target from $20.00 to $21.00, a 5% increase, signaling a slight improvement in the firm’s financial outlook for the chipmaker.

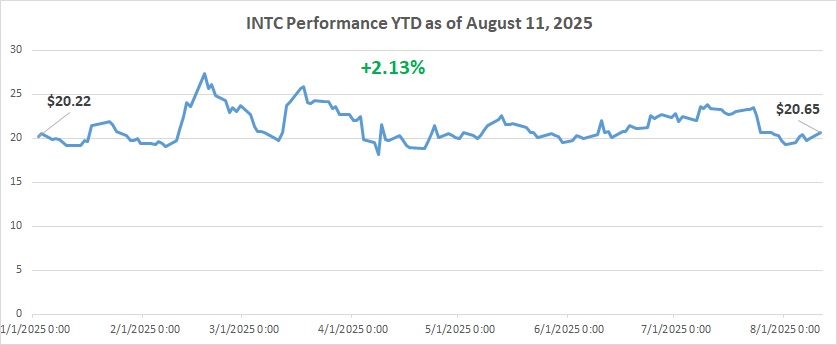

Year to date, the stock is up 2.99%, significantly lagging the S&P 500’s 8.36% gain over the same period. While the broader market has posted solid growth in 2025, Intel Corporation (NASDAQ:INTC) modest advance reflects weaker momentum and underperformance compared to the index, suggesting it has struggled to keep pace with overall market trends. Intel Corporation (NASDAQ:INTC) weak 2025 YTD momentum is driven by falling revenues, low yield chip production issues, and political pressure on CEO Lip-Bu Tan over past China ties. Manufacturing delays, competitive pressure from TSMC, and investor concerns have kept the stock lagging the broader market.

With its restructuring, new product launches, and growing role in AI, Intel is firmly on investors’ radars, making it one of the most trending stocks to watch in August 2025.

01. Palantir Technologies Inc. (NASDAQ:PLTR)

Search Volume on Google from 4 to 10 August: 200k+

Palantir Technologies Inc. (NASDAQ:PLTR) is one of the hottest trending stocks this month after smashing expectations in its Q2 2025 earnings report. The company posted earnings per share of $0.16, beating forecasts of $0.1382. Revenue jumped 48% year over year to $1.004 billion, marking the first time Palantir Technologies Inc. (NASDAQ:PLTR) has crossed the billion dollar mark in a single quarter.

The growth is being driven largely by its U.S. business. U.S. commercial revenue surged 93% from last year, while U.S. government revenue climbed 53%. Together, they now make up 73% of total company revenue. Palantir Technologies Inc. (NASDAQ:PLTR) Artificial Intelligence Platform (AIP) is fueling much of this success, winning major deals like a $10 billion, 10 year enterprise agreement with the U.S. Army and a $218 million contract with the U.S. Space Force.

Its commercial partnerships are just as impressive. Clients such as Citibank, Fannie Mae, and Nebraska Medicine have reported game changing results, from cutting fraud detection times from months to seconds to improving hospital efficiency by more than 2,000%. In Q2 alone, Palantir Technologies Inc. (NASDAQ:PLTR) closed 157 deals worth over $1 million each, with 42 exceeding $10 million.

On the financial side, Palantir Technologies Inc. (NASDAQ:PLTR) delivered a 46% adjusted operating margin and generated $569 million in free cash flow. Looking ahead, the company expects Q3 revenue to grow 50% year over year, with full year 2025 revenue projected to rise 45% to $4.146 billion.

On August 5, Wedbush reaffirmed its Outperform rating and $160 price target on Palantir Technologies Inc. (NASDAQ:PLTR) after the company delivered fiscal third quarter 2025 results that topped analyst expectations. The firm also ranked Palantir among its top technology investment picks for the year, citing the company’s ability to balance investments in engineering talent and product innovation with strategies aimed at expanding its bottom line.

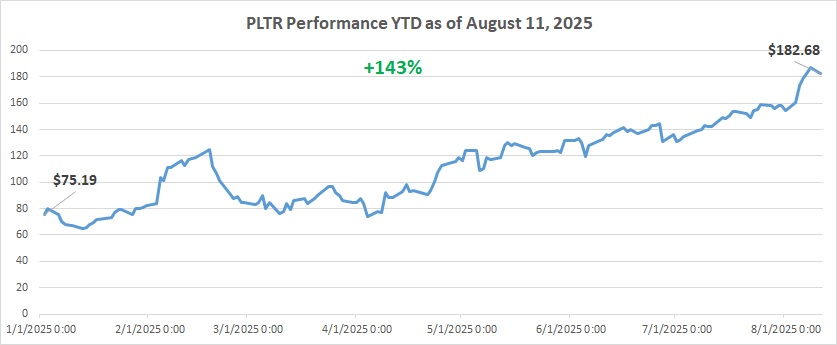

Year to date, Palantir Technologies Inc. (NASDAQ:PLTR) has delivered a remarkable gain of 143%, far outpacing the S&P 500’s more modest 8.36% increase over the same period. This significant outperformance highlights the stock’s strong momentum and investor confidence compared to the broader market. While the S&P 500 has enjoyed steady growth in 2025, Palantir Technologies Inc. (NASDAQ:PLTR) returns have been nearly 17 times higher, underscoring its standout position among market leaders.

With booming demand for AI solutions, expanding government contracts, and strong commercial adoption, Palantir Technologies Inc. (NASDAQ:PLTR) is firmly in the spotlight as one of the top trending stocks in August 2025. Investors see it as a key player shaping the future of AI across industries.

Read Next:

- 10 Best Performing US Stocks in 2025 So Far

- 10 Best Uranium Stocks to Buy in 2025 as Nuclear Energy Demand Rises

- 7 High Dividend Tech Stocks to Buy for Long Term Growth in 2025

Disclaimer: This article is for informational purposes only. See our full disclaimer. The article is originally published on TheRichStocks.com.