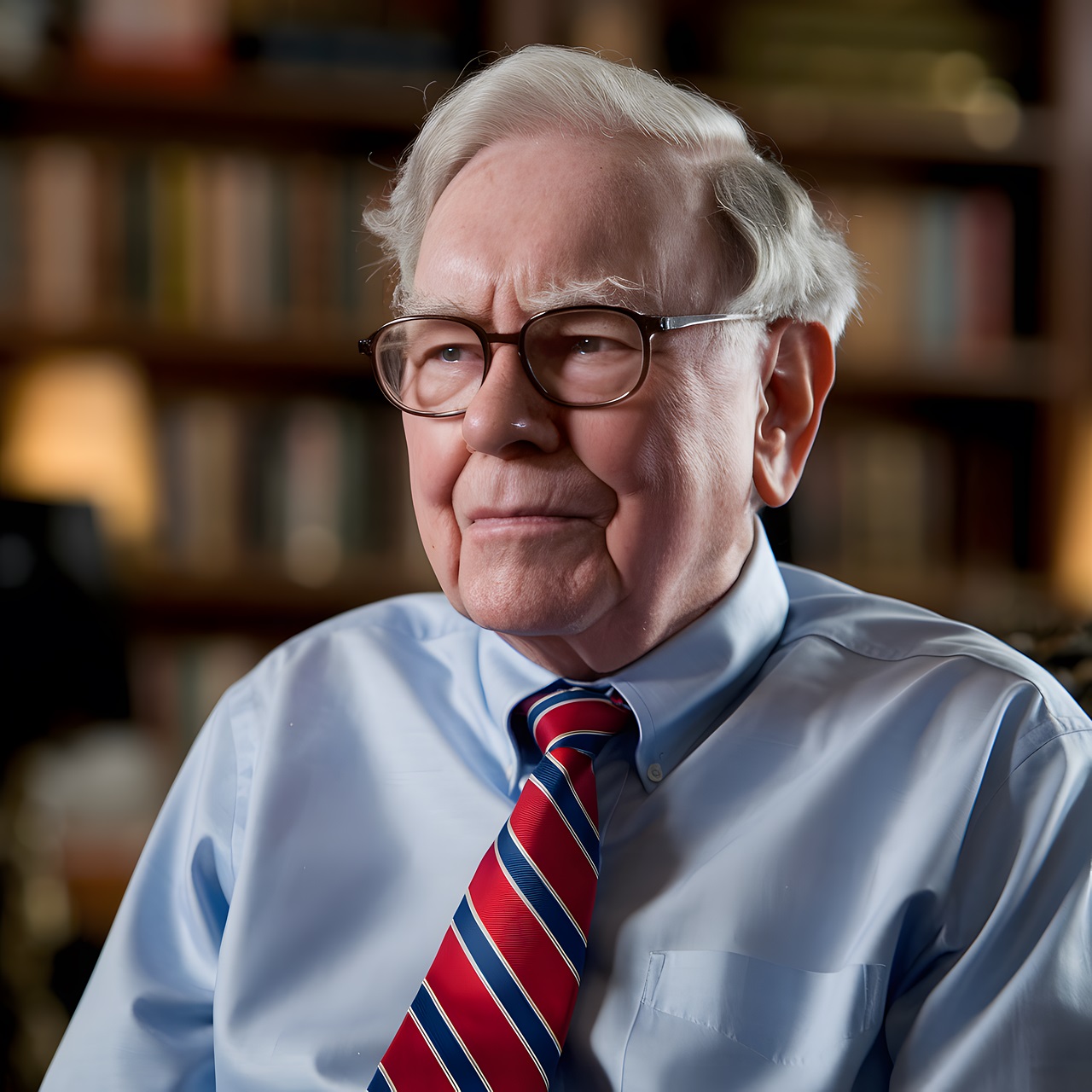

In this article, we explore the Warren Buffett portfolio and reveal the ten stocks where he holds the largest stakes.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has long been known for his ability to pick winning stocks and hold them for the long haul. His investment philosophy, rooted in patience, value, and quality businesses, has made his portfolio one of the most closely watched in the financial world. But what are the companies that Buffett believes in the most?

In this article, we dive deep into the Warren Buffett portfolio to uncover the 10 stocks where he holds the largest stakes. These are not just ordinary positions, they represent Buffett’s highest conviction plays, the companies he believes will deliver long term value and stability regardless of market cycles.

From iconic American brands to global industrial giants and behind the scenes tech infrastructure leaders, these top holdings paint a clear picture of Buffett’s investment priorities in 2025. Whether it’s his massive 44.8% stake in healthcare provider DaVita Inc. or his billion dollar bets on companies like American Express and Occidental Petroleum, each stock offers unique insights into how the Oracle of Omaha thinks about risk, growth, and resilience.

If you are looking to align your investing mindset with one of the greatest investors of all time, this list of Buffett’s largest stakes is the perfect starting point. Let’s explore what makes each company worthy of such a prominent place in the Warren Buffett portfolio.

Our Methodology for Selecting the Largest Stakes in Warren Buffett Portfolio

To compile this list of the top 10 stocks where Warren Buffett holds the largest stakes, we reviewed Berkshire Hathaway’s most recent 13F filing, submitted to the SEC on May 15, 2025. The data reflects holdings as of March 31, 2025, and is sourced directly from the EDGAR database. We ranked the stocks based on the total market value of Buffett’s stake in each company. This approach highlights the companies where Buffett has placed the biggest bets, offering insight into the core of the Warren Buffett portfolio.

Warren Buffett Portfolio: 10 Stocks Where He Holds The Largest Stakes

10. Mitsubishi Corporation (8058.T)

Warren Buffett Stake: 9.70%

Warren Buffett’s Berkshire Hathaway holds a 9.7% stake in Mitsubishi Corporation (8058.T), Japan’s largest trading company with global operations across energy, materials, automotive, food, infrastructure, and more. Despite a dip in net income to ¥700 billion forecasted for FY2025 (from ¥950 billion in FY2024), the company’s operating cash flow remains stable at ¥900 billion, highlighting the strength of its core operations and cash generating ability.

Mitsubishi Corporation (8058.T) is navigating headwinds in steelmaking coal prices and sluggish auto sales in Southeast Asia. However, long term growth drivers are in place, particularly its LNG Canada project, copper mining at Quellaveco, and rising demand from data centers in the U.S. Power infrastructure and real estate also offer meaningful upside.

Risks include continued pressure on commodity prices, regulatory hurdles in auto finance across ASEAN, and the slow ramp up of energy related projects. Yet Mitsubishi’s diversified portfolio, stable dividends, and Buffett’s vote of confidence point to its long-term value potential.

Mitsubishi Corporation’s inclusion in Warren Buffett’s portfolio highlights its global scale, diversified operations, and consistent cash generation, factors that likely contributed to Buffett’s substantial stake. Its position among Buffett’s top holdings reflects the long term strategic potential he sees in the company’s wide ranging industrial and energy interests.

09. Mitsui & Co., Ltd. (8031.T)

Warren Buffett Stake: 9.80%

Mitsui & Co., Ltd. (8031.T) may not be a household name globally, but it’s a vital engine in Japan’s diversified industrial ecosystem, and it has clearly caught Warren Buffett’s attention, with his stake reaching 9.80%. The company operates across a vast range of sectors, from energy and infrastructure to healthcare and chemicals, positioning itself as a multifaceted player with both traditional and next generation assets.

Financially, Mitsui & Co., Ltd. (8031.T) delivered a solid ¥900 billion in profits for the fiscal year ending March 2025. Although this was slightly below revised forecasts, base profit and core operating cash flow (COCF) remained strong, exceeding ¥1 trillion. The company’s commitment to shareholder returns is evident in its 15 yen dividend increase and a continued progressive payout policy. However, cautious assumptions for FY March 2026, especially in asset recycling and U.S. policy impacts, reflect management’s conservative stance amid global uncertainty.

One of Mitsui & Co., Ltd. (8031.T) strengths is its ability to generate steady returns through diversified investments and disciplined capital allocation. While exposure to commodity price swings and global macro risks remain, the company’s long term planning, resilience, and steady innovation signal ongoing stability within Warren Buffett portfolio. Mitsui’s strategic balance between risk and reward makes it a fascinating case of industrial endurance in a changing world.

08. Moody's Corporation (NYSE:MCO)

Warren Buffett Stake: 13.70%

Warren Buffett doesn’t invest in hype, he invests in staying power. That’s exactly what Moody's Corporation (NYSE:MCO) offers. With a 13.7% stake, Warren Buffett portfolio commitment to this integrated risk assessment giant reflects confidence in its steady earnings model and indispensable role in global finance.

Moody's Corporation (NYSE:MCO) operates in two segments: Moody’s Analytics and Moody’s Investors Service. The former powers financial institutions with data driven SaaS tools, while the latter provides credit ratings and risk assessments that underpin billions in global debt issuance. In Q1 2025, the company delivered record revenue of $1.9 billion, up 8% year over year, and an EPS of $3.83, beating expectations.

Private credit, AI powered KYC, and data center financing are driving growth in both ratings and analytics. Moody's Corporation (NYSE:MCO) also boasts recurring revenue of 96% in its analytics segment, a strong signal of customer stickiness and financial resilience.

That said, macroeconomic uncertainty and slower M&A activity have slightly tempered the company’s full year outlook. Yet, with adjusted operating margins exceeding 50% and robust free cash flow, Moody’s remains a compounding machine.

For long term investors like Buffett, and readers looking for quality, Moody’s combines consistency, innovation, and a front row seat in the future of credit and compliance.

07. VeriSign, Inc. (NASDAQ:VRSN)

Warren Buffett Stake: 14.20%

When Warren Buffett holds over 14% of a company, it signals deep conviction, and in the case of VeriSign, Inc. (NASDAQ:VRSN), that conviction lies in internet infrastructure. VeriSign might not make headlines like tech giants, but it plays a crucial role behind the scenes by securing and managing .com and .net domains, the backbone of global digital commerce.

In Q1 2025, VeriSign, Inc. (NASDAQ:VRSN) reported $402 million in revenue, growing 4.7% year over year. While earnings slightly missed estimates at $2.10 per share, the company showed strength in new domain registrations and renewal rates, indicating a stable and resilient business model. Cash flow remains robust with $291 million in operating cash and $286 million in free cash flow.

A major milestone this quarter was the company’s move to initiate a quarterly dividend, something Buffett often praises in long term compounders. With over $649 million in liquidity and continued share buybacks, VeriSign, Inc. (NASDAQ:VRSN) is committed to returning capital to shareholders.

That said, risks remain. Slower macroeconomic activity and cautious registrar behavior could weigh on domain growth. But for long term investors, VeriSign, Inc. (NASDAQ:VRSN) near monopoly in core domains, consistent cash generation, and now a dividend make it a quiet powerhouse in Warren Buffett portfolio.

06. American Express Company (NYSE:AXP)

Warren Buffett Stake: 21.60%

Warren Buffett has long praised American Express Company (NYSE:AXP), and with good reason. His firm, Berkshire Hathaway, owns a commanding 21.6% stake in the company, underscoring his deep conviction in its long term value. Founded in 1850, American Express Company (NYSE:AXP) has evolved into a global financial powerhouse, offering credit cards, payment solutions, and travel services across multiple continents.

In the first quarter of 2025, American Express Company (NYSE:AXP) posted robust results: revenue rose 8% year over year (FX adjusted), while earnings hit $3.64 per share, beating Wall Street expectations. The company added 3.4 million new cards, driven largely by Millennial and Gen Z consumers, showing its continued relevance across demographics.

AmEx benefits from a diversified revenue mix, 75% of its income comes from card fees and spending, not lending. This makes it less exposed to credit market swings. Its premium customer base remains loyal, with strong spending in restaurants, lodging, and international travel.

Financially, American Express Company (NYSE:AXP) is solid: credit performance remains healthy, return on equity hit 34%, and the dividend was recently raised by 17%. Risks include economic headwinds and softening in airline spending, but the company’s flexible cost structure and growth oriented investments make it well prepared. For Buffett, it’s a textbook example of a wide moat business with staying power.

05. Warren Buffett Portfolio Energy Bet - Occidental Petroleum Corporation (NYSE:OXY)

Warren Buffett Stake: 26.90%

Warren Buffett has placed a massive vote of confidence in Occidental Petroleum Corporation (NYSE:OXY), owning a hefty 26.9% stake in the oil and gas giant. Founded in 1920 and headquartered in Houston, Occidental Petroleum Corporation (NYSE:OXY) is more than just a traditional energy company, it operates across oil, gas, chemicals, and carbon capture segments, giving it a diversified edge in a volatile energy market.

In Q1 2025, Occidental Petroleum Corporation (NYSE:OXY) delivered strong performance across all business segments, generating $3 billion in operating cash flow. Production came in at 1.39 million barrels of oil equivalent per day, right at guidance levels. Efficiency improvements, like faster drilling in the Delaware Basin, are cutting well costs by over 10% year over year.

The company also aggressively paid down debt, retiring $2.3 billion so far in 2025, further strengthening its balance sheet. Its forward looking investments in carbon capture and low carbon ammonia hint at long term growth beyond fossil fuels.

Risks remain, especially from commodity price swings and global supply dynamics. But Occidental Petroleum Corporation (NYSE:OXY) flexible cost structure and focus on operational efficiency allow it to adapt quickly. Warren Buffett portfolio deep stake reflects a belief not just in the company’s current earnings power, but in its ability to weather cycles and grow shareholder value for years to come.

04. The Kraft Heinz Company (NASDAQ:KHC)

Warren Buffett Stake: 27.50%

Warren Buffett continues to hold a massive 27.5% stake in The Kraft Heinz Company (NASDAQ:KHC), signaling his long term belief in this iconic food and beverage giant. Known for household brands like Heinz, Kraft, Oscar Mayer, and Jell O, the company spans multiple categories, from condiments and cheese to beverages and ready to eat meals.

In Q1 2025, The Kraft Heinz Company (NASDAQ:KHC) reported earnings per share of $0.62, beating expectations and showcasing its ability to perform in a tough consumer environment. Management is focused on strengthening brand quality, boosting marketing efficiency, and investing in product innovation through its global Brand Growth System. This long term strategy aims to improve margins while keeping the product lineup fresh and competitive.

The company is also targeting 5% of revenue going toward marketing, signaling a shift toward consumer facing growth. However, inflationary pressures and tariff related costs are weighing on gross margins, especially in commodities like meat and coffee.

Despite macro headwinds, The Kraft Heinz Company (NASDAQ:KHC) remains a stable cash generator with a strong balance sheet. While volume growth may take time to rebound, strategic investments in packaging, automation, and product renovation position the company for steady performance. Warren Buffett portfolio enduring stake suggests confidence in Kraft Heinz’s resilience and upside potential.

03. Warren Buffett Portfolio 35.4% Bet on the Future of Audio - Sirius XM Holdings Inc. (NASDAQ:SIRI)

Warren Buffett Stake: 35.40%

With a massive 35.4% stake, Warren Buffett clearly sees long term value in Sirius XM Holdings Inc. (NASDAQ:SIRI), the dominant force in satellite radio and digital audio entertainment. The company operates across two major segments: SiriusXM, which powers subscription based radio through satellite and mobile platforms, and Pandora, its music and podcast streaming service.

In Q1 2025, Sirius XM Holdings Inc. (NASDAQ:SIRI) generated $2.07 billion in revenue and $204 million in net income, reflecting modest declines year over year. However, the business maintained a solid 30% EBITDA margin and reaffirmed full year guidance, signaling confidence in long term growth despite short term headwinds like auto market softness and ad spend pressure.

The subscriber base remains strong at 33 million, with churn improving and new content deals, like exclusive channels from Alex Cooper and Premier League coverage, driving engagement. Podcasting is a major bright spot, with nearly 1 billion downloads and a 33% YoY jump in related revenue.

Sirius XM Holdings Inc. (NASDAQ:SIRI) is also managing costs aggressively, cutting marketing and tech expenses while still investing in next gen in car platforms and content innovation. Risks include declining ARPU and exposure to car sales trends, but Warren Buffett portfolio large stake reflects trust in the company’s recurring revenue model, brand stickiness, and scalable digital strategy.

02. Liberty Live Group (NASDAQ:LLYVK)

Warren Buffett Stake: 36.60%

Liberty Live Group, backed by Warren Buffett with a sizable 36.6% stake, is deeply rooted in live entertainment and media, with strong ties to iconic names like Live Nation and Formula One. Headquartered in Colorado, the company not only promotes large scale music and sports events but also operates in ticketing, advertising, and sponsorships, making it a diversified player in the experiential entertainment industry.

In 2025, Liberty made headlines with its expansion efforts, including the pending acquisition of MotoGP’s parent company Dorna and new ventures like the immersive Grand Prix Plaza in Las Vegas. Formula One, one of Liberty’s crown jewels, reported strong early season performance with growing attendance, robust sponsorship renewals, and expanding digital viewership, especially in the U.S. market, where ESPN ratings are up 45%.

From a financial standpoint, Formula One had $2.8 billion in attributed cash and liquid investments by Q1 2025. Despite a dip in quarterly revenue due to race scheduling differences, long term fundamentals remain sound with $14.2 billion in contracted future revenue.

Risks include sensitivity to economic conditions and event timing variances. However, Liberty’s focus on fan engagement, sustainable innovation, and structural simplification suggests a well positioned growth trajectory, making it a long term holding Buffett clearly believes in.

01. The Crown Jewel in Warren Buffett Portfolio - DaVita Inc. (NYSE:DVA)

Warren Buffett Stake: 44.80%

Warren Buffett portfolio largest single stock stake, at a remarkable 44.8%, is in DaVita Inc. (NYSE:DVA), a healthcare company specializing in kidney dialysis. This massive investment underscores Buffett’s confidence in DaVita’s business model, even in the face of industry challenges.

Headquartered in Denver, DaVita Inc. (NYSE:DVA) is a leading provider of life saving dialysis treatments for patients with chronic kidney failure. Its integrated care model spans in center, at home, and inpatient services, along with lab diagnostics and disease management. Recently, the company partnered with the YMCA to launch a community outreach program for early kidney disease detection, a move that highlights its strong social mission.

Financially, DaVita Inc. (NYSE:DVA) delivered a solid Q1 2025 performance. The company reported earnings per share (EPS) of $2, beating Wall Street’s estimate of $1.75. Operating income hit $439 million, driven by cost efficiencies and robust performance in its international operations. Despite headwinds like a tough flu season and a recent cyberattack, DaVita reaffirmed its full year guidance.

One noteworthy risk is regulatory exposure, particularly around Medicare policy changes and drug reimbursements. However, DaVita Inc. (NYSE:DVA) appears well positioned to navigate these shifts, especially as it benefits from phosphate binder reimbursement and strategic share buybacks. In short, DaVita’s strong fundamentals and resilience justify its top spot in Warren Buffett portfolio.

Read Next: Disclaimer: This article is for informational purposes only. See our full disclaimer. The article is originally published on TheRichStocks.com.